There are so many things going wrong in the world that giving up in despair is more appealing. We know that immigration continues uncontrollably. As this results in high import taxes on goods the economy will be in trouble. If initiation of environmental protection is started, people will be at risk of losing their jobs but there is a danger that we will perish if we don’t save the environment.

This is a disharmonious sequence of apocalyptic scenarios. Worse still, we do not know who to believe. Politicians seem to be constantly yelling at each other rather than dealing with important issues.

In the middle of this freak show, we sometimes see that economists appear on television, make terrible predictions about the market, or criticize the economic policies of a candidate or another. It seems that economists are biased and take shape according to commercial interests or political ideology. We cannot grasp or how they have achieved misleading economic consequences.

This summary will provide information that will restore your confidence in the economy. Thanks to the realistic views of the two Nobel Prize-winning economists, you will see that most of the economic theories constantly raised by politicians are flawed and those social problems that seem difficult for many people have definite economic solutions.

Try Audible and Get Two Free Audiobooks

Chapter 1 – Economists can help us overcome the world’s most serious problems –but they have to give us a reason to trust them first.

In a public opinion poll on how much people trust the views of people with different professions, the opinions of nurses are in the highest rank in terms of reliability, it may not be surprising that politicians are in the lowest rank. Surprisingly, economists are just a little higher up than politicians. Their views were also seen as unreliable.

But why this discredit? It is because economists who constantly appear on the television news are perhaps not the most reliable. Generally, the economists appearing on TV are a company employee and have a predetermined agenda to save market interests.

Also, they may be academic economists with extreme views that are far from realistic. Regardless of whether they are on the right or the left, economists with ideological thoughts to inform the public not always offer the most detailed and reliable analysis. Even good economists often do not want to spend time explaining the evidence and reasons in a way that others can understand. Even worse, the views of academic economists can be understood by people as irrational and inconsistent because their thoughts often do not match the economic situation described by politicians.

It is problematic for people to suspect economists’ views. Why? Because they can provide very important information that shows us how to find solutions to the most serious problems in the world. So how can economist make us believe themselves and explain the economic issues as the way we understand them?

To begin with, they need to be willing to share their way of thinking and results with people. If we can easily access the data they use as evidence for economic inference and understand how they think about this evidence, we will be more likely to believe them.

More importantly, they should be able to accept that the evidence found can sometimes be misleading for economic analysis. Today’s political and economic debates have become a yelling show, in which both sides are sincerely and firmly committed to their perspectives. Economists should take a clear view of the reasons and review their ideas when necessary, and confess it when they make a mistake.

Chapter 2 – Politicians deceive voters with false statements about immigration.

The most controversial issue that is mentioned today is immigration. Politicians like Donald Trump have created a perception that they are surrounded by hungry immigrant armies that will destroy their country’s resources and threaten the identity of the natives.

Politicians use the simple model of economic supply and demand to explain why immigration is a major problem. The controversy argues that immigrants will head to the country fort he financial wealth of the first world countries such as the USA, and therefore will try to reach there in uncontrollable clusters. They will offer an excessive amount of cheap labor when they arrive, so salaries will decrease and domestic workers will lose their jobs.

This argument may make sense to people, but it is not based on evidence.

It is not true that the hope of more money is sufficient to convince immigrants to leave their home country. If this was true, most of the Greek population would move to richer European countries when the Greek economy was in crisis in 2013. They had no obstacles to immigration. Since Greece was an EU member, it was completely legal for Greek citizens to immigrate to richer neighboring countries nearby. But only about 3 percent of the population -350.000- started living elsewhere.

Studies have shown that people generally do not want to move from one place to another, even within the same country. For example, according to a study Indians living in rural regions such as Bihar and Uttar Pradesh can be able to double their income if they move to the city. However, only a small percentage of 100 million very poor people in these regions are moving to cities.

Because there are many compelling reasons that keep people in their countries: family ties, support relations and fear of unknown are just a few of them.

It is believed that only money will be a good source of motivation for paper. Who wouldn’t want to double their income? However, such a simple reason does not explain a wide variety of details of the human experience. How do you consider the fear of change? Or do you need to stay home to take care of your sick parents? Or is there a desire for our children to grow in the countryside with fresh air?

When dealing with the immigration issue, politicians use wrong policies. We do not need to prevent people from immigrating from their country. Rather, we must encourage them to immigrate. Because immigration can be beneficial for unskilled local workers. We will cover this in detail in the next chapter.

Chapter 3 – Immigration contributes to strengthening the local economy and offers new opportunities for local workers.

Imagine being a waitress for a moment and that your town is heavily filled with immigrants, as some politicians warn. You are worried that your new immigrant neighbors can take your job. But then you see that the restaurant is getting busy with their arrival.

Immigrants do not only bring a labor supply with them. They also increase the demand for services. They attract money to small businesses, such as cafes and shops, where low-skilled workers work.

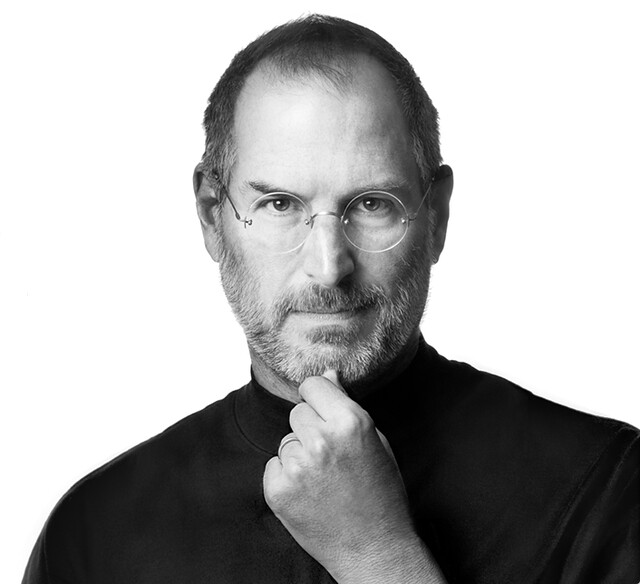

Wealthy immigrants can start their businesses, which creates more employment opportunities for natives. In fact, the ranking of the best Fortune 500 companies in 2017 has stated that 43 percent of America’s most profitable companies were founded by immigrants or their grandchildren. People like Steve Jobs, whose biological father was a Syrian and Henry Ford, who have an Irish immigrant descendant. Therefore, the idea that immigrants can destroy the labor market for low-skilled local workers has been refuted. This is not only because they strengthen the economy. There is another reason: ımmigrants are too inexperienced to compare with local workers’ social networks and local knowledge.

According to supply and demand theory, employers will always want to employ the cheapest labor; that is, if immigrants work for less Money, domestic workers lose their jobs. But deciding which worker to employ is not like choosing a watermelon. There are more serious evaluations than price to measure a worker for employers. They want to make sure that the worker will work efficiently and be reliable. Otherwise, they will have to fire them, as it will do more harm to them. For these reasons, employers are more inclined to hire people they know or have strong references. Local workers who have already worked in the job, even if they demand more wages, will always be the first choice by employers.

Local people are also more advantageous in finding jobs from immigrants, as they can speak the language fluently. According to a Danish study, in regions with a higher population of immigrants, Danish workers turned out to be more inclined to leave low-skilled jobs for more skilled jobs.

Therefore, immigrants often have jobs in areas where local workers do not want to work, such as cleaning, mowing, or childcare. The excessive workforce in these jobs can lower wages, but even this can benefit workers. For example, if you are a low-income mother from the local community, you can use affordable childcare so start working outside and earn money to increase your income.

Chapter 4 – Goods can circulate freely in global trade agreements, but people and money cannot move so easily.

Supporters of international trade agreements reveal a very positive situation: each country will export the best goods in production and import the more affordable one when supplied from another location.

Thus, Egypt can export labor-intensive items such as hand-woven carpets, using the cheap labor force in the country. China can use its large technological resources and productive factories to export mass-produced computer parts. These parts can then be purchased cheaply by Indian companies that support the local technology industry.

Thinking a little bit, while international trade destroys some industries and businesses, factories can stop producing nonprofit products and innovate to produce efficient goods. And workers can move to more lucrative industries.

The problem with this idea is that it assumes unrealistic flexibility for both industry and labor force.

As mentioned in the previous chapter, workers are not as flexible as the trade theory assumes.

Even if financial incentives are provided to do this, they see moving from one place to another as a challenge. This prevents industries from transforming because this usually requires moving to a new commute area.

Companies may also not be very flexible. Economist Petia Topalova, while a Ph.D. student at MIT, did detailed research on the impact of global trade in India. She found that it is extremely impossible for a company to stop the production of a product even if its production does not bring profit.

While new companies are established to produce more innovative products in theory, in practice they often have a hard time getting loans from banks. Conversely, older companies continue to receive financial support again, even they are in crisis.

And even if a new company manages to enter the local market with a new product, it is not that easy to compete in the global market.

Also, it takes a long time to develop a reliable reputation. Foreign buyers avoid buying goods from companies that have just entered the market without timely deliver you consistent quality guarantee. Therefore, companies in developing countries are often treated with suspicion. This can turn into a vicious cycle. For example, if no one invests in a small business that produces Egyptian carpet, this small business cannot improve its quality and employ more workers for mass production.

Chapter 5 – Trade agreements can jeopardize the work of local workers, but protectionist tariffs are not a solution.

You’ve most likely seen the record of Trump surrounded by steelworkers in 2018 and announced that the U.S. declared that it will apply a heavy tax on aluminum and steel imported from China to save local companies.

Is this tactic useful? Steelworkers will likely be able to hold their jobs with this protection measure. People will tend to buy local steel due to high taxes, so there will be fewer job cuts in these factories. As there will be more steel demand.

In response to Trump’s steel taxes, China declared that it will use its taxes on the USA agricultural products. As China is known to purchase 16 percent of all crops and meats from the USA, this will have serious consequences for the US agricultural industry. While steelworkers can hold their jobs, farmers will lose their workers as exporting agricultural products to the Chinese market has become very expensive. Therefore, Trump’s trade strategies are far from being far-sighted.

With the impact of “Chinese shock”, factories being unable to compete with cheap Chinese import goods were closed. Bruceton town in Tennessee gives an alarming example.

Bruceton was forced to close its factory by laying off 1,700 workers because clothing production was no longer profitable. In 2000, they fired the last 55 workers. Dismissed workers could no longer spend money in the town, which means almost all local businesses were closed. The center, once a thriving place, turned into a ghost town. This stagnant state of the town prevented investors from establishing new companies in the town. We already know that unemployed workers cannot always easily migrate to another region to find a new job. But they have no hope of salvation to keep them. So what do they do in this situation?

The U.S. has a support program to help those who have lost their jobs, known as the Trade Adjustment Assistance (TAA) program. The program extends the duration of workers’ unemployment insurance and provides training and support to integrate them into a new industry. It also provides financial assistance to make it easier for workers to migrate to another location. The program has all the necessary components, but very few sources.

People who cannot compete in global trade need support, just putting extra taxes fort his purpose will not solve anything. Instead, we should fund important support programs helping newly unemployed workers to overcome this shock and recover as soon as possible.

Chapter 6 – Attempts to end climate change cannot be separated from the fight against economic inequality.

At the end of 2018, the protester crowds, called “yellow vests” poured into the streets of Paris, harshly protesting a tax on gasoline. They assumed that this decision was a movement designed to harm the poor while protecting the elite. Wealthy Parisians can use the metro line to go to work. However, poor people who live in suburbs or rural regions and have to drive to Paris for income cannot pay this new tax.

The claim that tackling climate change is a luxury deal that the poor cannot afford is very common. The idea that we can save the planet for the future or protect the economy today is also known to everyone.

But today, those who have to pay the price of climate change, especially in developing countries near the equator, are also poor people. If the temperature rises a few degrees in Scandinavia, it results in a pleasant warm. But if the temperature rises in India, the heat will be unbearably burning.

Worse, most people in India are poorly equipped to overcome high temperatures. Unlike 87 percent in the United States, 5 percent of households in India are air-conditioned.

According to the idea that the ultimate goal is economic growth, if it will affect the economy positively, it means that we will be threatened with the idea of reducing energy consumption. But there is no solution for this. In order to stop the heat change, it is necessary to reduce energy consumption. Is it possible to do this in a way that does not harm those who are most vulnerable to change?

In addition to taking measures to reduce gas emissions in rich countries, we need the distribution of financial help to support developing countries that bear the heavy burden of climate change. Let’s consider the presence of the air conditioner in India. Financing cleaner air conditioners that do not produce HFC gases for Indian families would cost the richest countries a small amount of their GDP.

It is not necessary to use the poor to save the planet but wealthy countries must be ready to pay the price of climate change.

Chapter 7 – Artificial Intelligence is developing to perform more complex human tasks, having a negative effect on the labor market.

You already know the script in science fiction movies: Robots took our jobs first and then took over the world.

It may seem a little distant, but can it be real? Today, robots can cook burgers, clean floors, and even be used in complex logistics.

What about the people working in these jobs? What will happen to them with the development of artificial intelligence and continuous automation? It is hard to answer these questions because technology is developing so quickly.

Although we cannot predict the future, we can examine the effect of mechanization in the past. Researchers found that the use of robots in factories had a negative impact on the labor market. The introduction of only one industrial robot in a workplace reduced 6.2 jobs and low wages.

While essentially manual Works have been automated so far, more sophisticated tasks such as bookkeeping, sports journalism, and lawyer assisting will be able to be performed by robots with the development of AI. Only highly skilled jobs such as computer science and engineering and very low skilled jobs like dog-walking will remain. People who are not university graduates are inevitably the most vulnerable groups of people.

Currently, even if a robot does not work more efficiently at work, the use of a robot by a US firm may be more financially lucrative than hiring a person. Employers do not need to give maternity permissions or pay payroll taxes for a robot worker. To encourage companies to employ robots helping improve human business instead of replacing people, we can create a tax penalty system that makes it more financially beneficial to hire a person.

The main problem is that it becomes more difficult to determine where the robot will stop and where humans will start. Most robots do not spin in a shiny silver case; they are usually placed on machines with human operators. It can be very difficult to decide what exactly constitutes a “robot”.

However, economic inequality is not limited to robots. As we will learn in the following chapter, this inequality is more about social policy than technology.

Chapter 8 – We’ve met economic inequality before intelligent robots.

It might be easier to blame robots for economic inequality. They are the last invading strangers in our society and therefore a very suitable scapegoat for many problems.

However, inequality was a growing phenomenon long before the intelligent self supermarket cashiers were invented. In fact, we cannot understand the impact of artificial intelligence without examining the labor market in detail and looking at how income is distributed in society.

Until 1980, the share of national income led by the richest 1 percent in the United States declined from 28 percent in 1928 to one-third of this in 1979. However, this trend has changed drastically since 1980, so inequality remained at its level in 1928. Income inequality has almost doubled since 1980.

While the income of the richest 1 percent increased rapidly, working-class wages gradually decreased. Indeed, the average worker wages in 2014 were not higher than in 1979 when it was calculated according to inflation.

The least educated workers are the group most affected by this inequality: ın 2018, male workers’ wage was 10-20 percent lower than in 1980.

So what caused this enormous increase in inequality in 1980? Many economists showed that the policies of leaders such as Ronald Reagan and Margaret Thatcher, who came to power with aggressive policies, attempted to reduce the taxes of the wealthy, so the income came as a drop to the average worker.

The economic philosophies of the Reagan-Thatcher period also brought the idea that some people deserve the highest wages. Reason? they were very skilled at their jobs and getting good wages would encourage them to work harder.

However, this reveals the fact that CEOs in the financial industry often earn bonuses without doing anything. Since their salaries are adjusted to the market value of the company, they get more money when the company is successful. However, low-wage employees are not paid more, on the contrary.

This huge income inequality between the most earners and everyone else cannot be maintained. What do countries like the US need to do to solve this problem? Only one solution: taxes.

Chapter 9 – A suitable taxation system can help the government to solve the economic inequality problem.

There is a way to balance the playground between exorbitant top earners and other employees: taxes. According to the studies, when the tax rate of the top 1 percent earners is 70 percent or higher, salaries are more evenly distributed. So companies stop paying exorbitant salaries because they don’t want to pay a 70 percent tax to the tax office.

Countries such as Germany, Spain, and Denmark, which maintain such high taxation, have less gap between the highest and average salary than the countries that reduce taxes for the best salaries, such as the USA, Canada, and the UK from the 1970s onwards.

However, governments will need more resources to truly cope with inequality. ıt is necessary to do more than charging taxes on the salaries of the wealthiest people.

It may be another option to impose a wealth tax on the assets of extremely wealthy people. A 2 percent tax on assets exceeding 50 million dollars and a 3 percent tax on those exceeding billion dollars could potentially generate $2.7 trillion in a decade. This amount is nothing for billionaires but it can make a huge difference in the lives of millions of people. If this money is used to help unemployed people suffering from global trade or to fund other public programs such as housing and education, this can be achieved.

However, asset taxes are not sufficient. Everyone will have to put their hands under the stone to make a difference.

Denmark and France, two countries with effective programs for poverty and inequality, increase 46 percent of GDP by taxes. most of these taxes are collected from average income earners. By contrast, taxes are only 27 percent of the US GDP.

In the USA, the idea of paying more taxes could not find support. This is because the level of trust in the government is partially low. It is often considered that government programs are often inefficient and officials are corrupt. People have justified concerns about where their money is going.

The government should plan to use taxes for good purposes. But these planning Works are important. As you know, when it comes to paying attention to human welfare, the market is not always productive. There is a need for solid public programs to support workers suffered by global trade, artificial intelligence, climate change, and the countless future challenges. We need money from taxes to provide resources for these programs.

Chapter 10 – There is no suitable solution for everyone to end poverty, but it is essential to highlight the dignity of the poor.

Imagine that a robot is hired as a bookkeeper instead of you. Or the regular work you found in an organic farm is gone with the negative impact of the trade war with China. Or your job at an Indian clothing factory is at risk as Korean textile imports are more affordable for the West.

Because of these layoffs and unemployment, you and your family have to deal with major economic problems. But the only thing missing will not be money. You will also be at risk of losing your working community, your identity at work, and even your dignity.

Poverty can happen very quickly without social security support. Envy can drive a family into poverty. It should be kept in mind that when attempting any aid, it is necessary not only to meet the financial needs of the family but also to treat them with respect as a necessity of being human.

Unfortunately, many support programs cause poor people to be perceived as evil.

Policymakers suggest that the poor should not be trusted to spend their money on useful things such as food and education and therefore should not be given cash. Those who criticize money transfer to poor people say that if the poor are humiliated in this way, they cannot encourage them to work; instead, they will spend their days aimlessly wandering.

But these fears have no solid basis. According to experiments in 119 developing countries that give direct financial support to very poor families, it shows that nutrition and health level have increased significantly for the beneficiaries. But alcohol and tobacco expenditures did not increase.

People with basic income do not stop working. According to an experiment by one of the authors in Ghana, participants were asked to make bags that would purchase in a signşficant amount. Some of the people who participated in the experiment were given goats to make them earn more money. The experiment showed that participants with goats not only produced more bags but also higher quality bags than people without goats.

Instead of preventing poor people from working, financial aid can save them from the stress of life struggle and enable them to work harder, try something new, or settle elsewhere.

There is no suitable solution for everyone to end poverty. A solution implemented in Ghana may not work in the US. It is more important to take into account the social context and to pay attention to the agency and dignity of the beneficiaries.

Chapter 11 – We have to listen to each other to end the political polarization and bias undermining democracy.

According to the FBI data, the hate crime rate in the US increased by 17 percent in 2017. It was the third year in which this number increased in sequence. Before 2015, the number of hate crimes for a long time tended to be steady or decreasing.

How can we explain these rising figures? What causes someone to hate black people, immigrants, or people of a different social class? Do some people hate them because they were born biased and grew up like that? Or does the influence of the media cause it, or the discourse of an anti*immigrant president like Donald Trump?

These questions make economists and other social scientists busy. It is absurd to say that people have instinctively racism and prejudice because this means that they ignore their history and social context. However, to say that people are brainwashed because of what is said by media means that they underestimate the people’s intelligence and perceptions. The answer is more complicated than it seems.

While people have individual preferences, these preferences are shaped by social groups and certain situations in which people find themselves. People are drawn to people who are like them. The community then becomes a kind of mirror room for a particular view and people can strengthen each other’s beliefs without being exposed to outside opinions.

This means that even in scientific reality like global warming, many different views can emerge. 41 percent of Americans say that global warming is the result of pollution caused by humans. However, the same number of Americans either do not believe there is global warming or believe it is a natural phenomenon. These different views are also politically separated: republicans don’t believe there is global warming while democrats tend to believe it.

Our perception has been shaped by social media platforms such as Facebook, in which we have friends who share the same opinions and we see things that we already believe in.

Democracy does not matter if we communicate with each other on important issues. We are divided into small fractions that struggle with ideological debates just for the sake of victory.

Even the most radical bias can change. But for this to happen, we need to communicate with different types of people with different opinions. Schools and universities are important places where such different social interactions occur, like mixed neighborhoods including the rich and the poor.

With open discussions, we can begin to solve many problems that are breaking our societies.

Good Economics for Hard Times: Better Answers to Our Biggest Problems by Abhijit Banerjee, Esther Duflo Review

Economists have a bad record in the society but they can find solutions to many serious problems that we have to deal with. some of these issues are how to overcome economic inequality and layoffs caused by the trade war, how to end climate change and aid workers affected negatively by the introduction of AI. governments need solid plans to find effective solutions to these problems. Income should be distributed equally by increasing taxes and financially supporting the poor and creating innovative social programs that provide job opportunities. Most importantly, we should reassess the idea that economic growth will benefit everyone and examine the financial effects of it on the planet and human well-being.

Try Audible and Get Two Free Audiobooks