Do you appear to wind up without enough cash? Do you find that cash slips from your hand as quick as a bar of cleanser? Do you think that it’s simpler to put your head in the sand instead of face your bills or audit your bank proclamations?

If this seems like you, you’re surely not the only one. Being acceptable with cash is not a characteristic practice for the majority of us.

This summary is intended to assist you with overseeing your accounts by furnishing you with the information and aptitudes you need to make educated decisions about cash. All in all, what are you sitting tight for? It’s an ideal opportunity to get learning, begin saving, and anticipate a more quiet, safer future.

Try Audible and Get Two Free Audiobooks

Chapter 1 – You can land a less expensive home loan by putting something aside for a bigger store and getting control over your costs.

We should start by tending to quite possibly the most unwieldy monetary issues of our period – and what is doubtlessly your biggest cost – lodging.

In the course of the most recent couple of many years, house costs across Western nations have raised quickly. This has made the possibility of home-possession only an unrealistic fantasy for an entire age of youngsters.

A report by the Institute for Fiscal Studies appraises that normal house costs across the UK have ascended to in any event multiple times the normal compensation of 25 to long term olds, and in London, it’s as much as multiple times.

Given that you’re probably not going to have the option to get more than four or multiple times your compensation with a home loan, you can perceive any reason why there’s a reasonableness issue – the numbers simply don’t make any sense.

Lamentably, for those needing to jump on the lodging stepping stool, there are no brisk arrangements. In any case, there are things you can do to show up safer to banks, and that will assist you with acquiring and secure a less expensive home loan.

Regardless of whether you can stand to purchase a house truly relies upon two things: would you be able to raise enough for the store, and would you be able to persuade the bank to allow you to acquire the rest?

Concerning, the overall principle is that the more you can put toward a store, the less you need to acquire, and the lower your loan fee is probably going to be. Most first-time purchasers may have the option to manage the cost of a store equal to 5 percent of the estimation of their home.

Be that as it may, here’s some counsel: if you can figure out, at any rate, a 10 percent store, you ought to – because this is the edge for significantly less expensive financing costs.

Regardless of whether the bank will allow you to get the lay relies predominantly upon your pay, which you most likely can’t do a lot to change. Yet, one thing you can do is collaborate with another salaried individual, which will viably twofold the amount you can get.

Your outgoings are likewise significant. You’ll need to show in any event three months of bank proclamations – or a few years of bank explanations in case you’re independently employed – so you mustn’t default on any bills or make inordinate buys inside this period.

This profound jump into your accounts may appear to be unnecessary, however, it ought to likewise make you consider whether you can stand to make the month to month reimbursements on a home loan for pretty much your life. Or on the other hand on the off chance that you even need to.

Chapter 2 – Improving your financial assessment can improve bargains on credits and home loans.

Another pivotal factor that banks see while assessing you for a home loan or any advance, besides, is your FICO rating.

Your FICO rating is a number made by credit reference organizations. These organizations monitor your cooperations with monetary foundations like banks and energy providers. A financial assessment can assess your previous acquiring conduct with the goal that banks have some sign of how likely you will be to reimburse a credit later on.

FICO ratings are significant for everything from applying for a Mastercard to being acknowledged as an occupant. However, above all, they’re basic for getting less expensive home loans.

Any imperfection on your financial assessment, because of, state, defaulting on a bill for quite a long while, could get you turned down for a less expensive home loan, costing you thousands in additional interest.

Another characteristic of the FICO assessment framework that has since quite a while ago confused borrowers is that having no record as a consumer is regularly more terrible than having a negative record of loan repayment.

Yet, simply think, if an outsider approached you for cash and you didn’t have the foggiest idea about anything about their set of experiences of reimbursing advances, you’d presumably be hesitant to hand them cash as well. Moneylenders need something to go on.

This can be an issue for first-time purchasers who haven’t yet gotten the opportunity to fabricate a financial assessment. The least demanding approach to cure this is to begin getting modest quantities. You could, for instance, assume out an acknowledgment card and begin utilizing it for everyday expenses however ensure you take care of it in full every month!

There are a lot of things you can do to improve your FICO assessment. For one, you can cover every one of your tabs on schedule. Defaults will remain on your credit report for a very long time!

Additionally, try not to apply for such a large number of monetary items inside too short a space of time – things like bank accounts, advances, and charge cards – as this doesn’t go down well with a lot of moneylenders. What’s more, recall, regardless of whether your application is turned down, it’ll influence your FICO assessment.

It very well may be incredibly disappointing realizing that these puzzling credit offices have a particularly terrifying measure of authority over your life. Remember that you do have certain rights. If there’s anything on your credit report you believe is out of line, contact the office to have the issue explored and, ideally, struck off.

Chapter 3 – Regardless of how much obligation you have, it’s not unmanageable.

Exorbitant housing is one issue that characterizes this age – another is an obligation. Regardless of whether it’s life-time contracts, galactic understudy loans, or spiraling Visa obligation, we’re up to our eyeballs in the stuff.

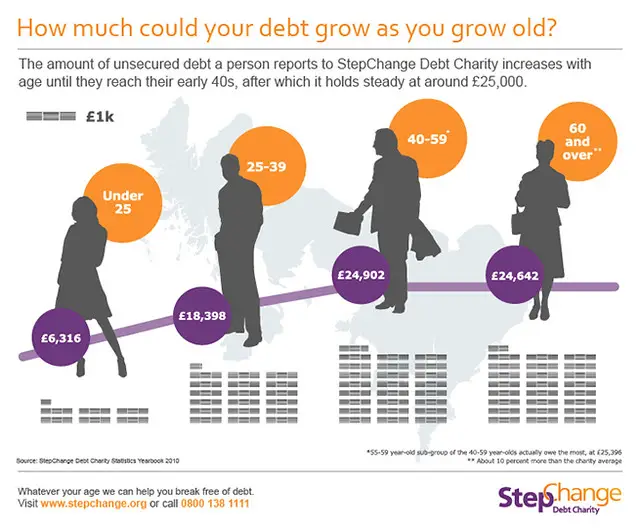

The obligation noble cause StepChange gauges that, in the UK alone, 21 million individuals are battling to take care of their tabs on schedule, and 3.3 million individuals experiencing serious issue obligation.

Along these lines, in case you’re battling with obligation, you’re positively not the only one. Yet, you need to keep steady over it. Seeing how to deal with your obligation will save you a great deal of agony and cash later on.

This may appear glaringly evident, yet the overall general guideline when getting cash is to get as meager as could reasonably be expected and take care of it as fast as could reasonably be expected. That way, you limit the measure of interest you need to pay on top of what you acquired.

Along these lines, we should envision you’re £3,000 underwater on your charge card, and you need to pay 19 percent interest. If you just compensation the base required installment every month – state £74 – it would take you 27 years to take care of your obligation in full and would cost you £7,192 altogether.

That is more than twofold what you acquired. If all things considered, you drove yourself to pay £108 every month, you’d take care of everything after just three years, and it would just cost you £3,879 by and large.

It doesn’t pay to cover your head in the sand and imagine your obligations don’t exist. You’ll just amplify the sorrow you need to look down the line.

In case you’re truly battling with your obligation reimbursements, you should contact your leaser to mastermind a more reasonable reimbursement plan. If you clarify your circumstance, numerous banks will likewise offer you some premium free breathing space of at any rate 30 days.

The bombing that, you do have different alternatives. Obligation truly shouldn’t be something to lose sleepover. Keep in mind, no obligation is unrealistic. Indeed, even liquidation isn’t too hard to skip back from should you choose to start from scratch and start once more.

In case you’re in a considerable measure of issue obligation and you’re thinking that it’s staggering to pay off, at that point find support. There are a ton of establishments out there devoted to aiding individuals in your position. In case you’re in the UK, look at StepChange’s online obligation number cruncher and free counsel administration.

Chapter 4 – You can plan your budget successfully without bringing down your way of life.

Lamentably, with lodging expenses and the obligation to pay off, the majority of us exist in a steady condition of requiring more cash. If we can’t procure more, there’s truly just a single choice left – planning.

However, planning doesn’t generally fall into place for us. It regularly feels simpler to streak our plastic than to get control over our enticements.

Maybe the issue is that we regularly take part in retail treatment to cause ourselves to feel good. In this way, when we hear the word planning, it conjures a feeling of puritan-like restriction and life as plain as breadsticks.

Yet, planning truly doesn’t have to infer a diminished personal satisfaction. We as a whole realize that a great deal of what we purchase doesn’t make us any more joyful. Thus, planning isn’t tied in with scaling back life’s delights; it’s tied in with scaling back unnecessary spending. What’s more, to do this, we should be somewhat less negligent with our charge cards and somewhat more careful.

This is the place where the Japanese idea of Kakeibo can truly help us. The word in a real sense means a sort of family record where you monitor your everyday costs. In any case, it likewise alludes to the way of thinking and craft of individual cash the board.

The guideline objective of Kakeibo is to instill a feeling of care into your ordinary spending. Truly, simply monitoring your spending is in some cases everything necessary to get control yourself over. If you realized that the £4 plate of prawn gyoza you purchase for lunch each day costs you over £1,000 per year, you’d likely make your lunch all the more regularly.

The initial phase in the Kakeibo strategy is to do some essential bookkeeping. Record your complete payment for the month and afterward take away all the essential costs from this figure, for example, lease and bills. Next, settle on an investment funds target – possibly 20% of your pay – and take away this from the complete also. At that point partition what’s left into four, and you have you’re going through cash for the week.

The subsequent stage is to partition your cash into pots. Let’s be honest, if there’s cash in your present record, in your eyes, it’s presumably going to be a reasonable game for spending. So isolated that cash into various records when your compensation comes in every month: one for investment funds, one for basics, and another for ordinary spending.

The Kakeibo strategy puts forth it simple to save with negligible attempt. Since you do all the figurings ahead of time, you don’t have to battle with the psychological math while your card’s now ready.

Chapter 5 – Putting your cash in an asset is a protected method to develop your reserve funds.

Since the 2008 monetary accident, loan costs have tumbled to record lows, even lower than expansion. That implies your investment funds are developing more gradually than the money is diminishing in worth. At the end of the day, you’re losing cash.

Hence, you’re seemingly in an ideal situation removing your cash from your bank account and placing it into a speculation reserve all things being equal, as these normally have better returns.

Be that as it may, stand by a second. Contributing? Don’t you need to be overflowing with money to contribute?

All things considered, not actually, not except if you plan to go full Wolf of Wall Street. Truly, putting away your cash isn’t any more muddled than opening an investment account – all you require is an extra night after work.

In any case, truly, perhaps you don’t understand anything about contributing. Where do you start?

You’ll no doubt put resources into an asset using an online stage known as an asset store. These are organizations that oversee your ventures for your sake for a charge, and in return, they offer different devices, counsel, and illustrations to assist you with dealing with your portfolio.

Except if you truly need to get included, you don’t have to settle on any choices about which offers or resources to put resources into. The solitary choice you need to make is which venture supports you need to commit.

Speculation reserves resemble a major pot wherein a lot of discrete financial specialists have pooled their cash. Just the asset chief – somebody who understands what they’re doing – settles on the troublesome choices about where and what to put resources into.

This is all extraordinary, however, isn’t contributing hazardous?

In principle, indeed, there is a component of danger associated with contributing. In any case, by and by, in case you’re just putting resources into reserves, you’re exceptionally far-fetched to wind up with less cash than you began. That is because the general purpose of a venture reserve is to limit hazards.

It does this by giving everyone in the asset a rate stake in a lot bigger and more different spread of resources than any individual could manage without anyone else. The more assorted the spread of resources, the less weak speculators are to changes in the estimation of any one sort of resource.

This training is called expanding – also called not tying up your assets in one place – and it’s one of the mainstays of safe contributing.

Eventually, the experience of putting your cash in an asset is a lot equivalent to keeping it in a bank account, so certainly think about it as a real choice for developing your cash.

Chapter 6 – The previous you set up an annuity plan, the better.

Annuities are the most un-provocative of all individual accounting themes – and that is stating something.

Putting something aside for a future that may never occur, in records that you can’t contract for quite a long time, is the most un-fun sort of saving. In any event, putting something aside for a house or an occasion gives you something substantial to anticipate.

In any case, it’s imperative to put something aside for your future. You might not have any desire to hear it, however some time or another you’ll be old. Furthermore, with normal future crawling ever upward, you likely won’t have any desire to even now be serving espressos you’re pushing 100.

The hard truth is, it’s smarter to begin contributing toward an annuity when you’re youthful. The sooner you start, the additional time you’ll need to make commitments and develop your pot on account of the marvel of progressive accrual.

In any case, for what reason do you at any point need benefits? For what reason wouldn’t you be able to simply keep your cash in a bank account?

Indeed, governments are sharp for their residents to put something aside for retirement while they’re youthful and still ready to acquire. Along these lines, to urge you to save, they offer pretty liberal duty reliefs on the target you put into a benefits pot.

At its least complex, a benefit is simply a bank account or a speculation reserve that has been enveloped by a tax reduction.

That is the reason an annuity is a more worthwhile approach to set aside than just throwing cash into a current record of reserving it under the bed until you’re 70. The drawback is that you need to bolt that cash away until you resign.

Things being what they are, what amount would it be advisable for you to be saving?

Support yourself, since it’s most likely substantially more than you envisioned. Most specialists state that to keep up a similar personal satisfaction you have now, you’ll need around 66% of your present compensation for each time of retirement, which you ought to expect will be at any rate 20 years.

Thusly, on the off chance that your present compensation is about £30,000, at that point to have a yearly payout of £20,000 more than 20 years of retirement, you’ll need to save £400,000. To save that sum, you’d reasonably need to save about £750 every month in your annuity store.

This probably won’t coordinate with your circumstance precisely, yet it should light a fire under you. The most effortless approach to sort out the amount you need to save is to utilize an online benefits number cruncher.

Chapter 7 – Examining accounts consistently and transparently can improve your relationship.

The creator’s anguish auntie segment once got an allure from a young lady in an inquisitive issue.

She composed that she’d quite recently moved into her sweetheart’s condo to help save money on a lease. However, at that point, her beau, who had a home loan on the condo, requested that she pay him a lease.

She composed that while, from one perspective, it appears to be reasonable that they should share the bills, then again, would she say she isn’t simply encouraging him to take care of his home loan on a property in which she has no stake?

What do you think? Is the present circumstance reasonable? Or on the other hand, would she say she is being exploited?

Clue: there’s nobody right answer for sharing the funds.

Eventually, it’s dependent upon each couple to work through a plan that works for them. Be that as it may, couples aren’t continually going to concur, so they ought to be ready for some off-kilter discussions around the supper table.

It shouldn’t come as unexpected that cash is the most widely recognized wellspring of contention between couples in relationship guiding.

A contributor to the issue is that accomplices frequently have altogether different assumptions regarding the social estimation of cash and how it ought to be spent. For instance, one accomplice may decipher rich spending on garments as a statement of achievement, while different believes it’s outright inefficient.

Hence, couples instructors suggest open and normal correspondence about monetary assumptions – particularly if you have joint funds.

Any feelings of disdain around cash should be broadcasted and discussed with your accomplice. While these regularly feel unimportant and not worth discussing, they can without much of a stretch turn crazy and cause more ruinous clashes.

A strategy utilized in couples’ advising to help reestablish trust around funds is contracting. You can attempt it at home as well. The thought with contracting is that you cooperate to set out a progression of monetary rules that you both approve.

You may, for instance, the agreement that the other isn’t permitted to remark on any buys you make with your record. Or on the other hand, you may choose how much every individual should add to the lease, and bills were given your various pay rates.

Keep in mind, reasonableness seeing someone doesn’t generally imply that each accomplice should contribute a similar measure of cash. It’s uncommon to discover a couple who both acquire a similar pay when they meet and keep on procuring a similar pay for the term of their coexistence.

Chapter 8 – Dealing with your cash likewise requires dealing with your passionate relationship with cash.

Cash probably won’t have the option to get you satisfaction, however, continually feeling like you need more of it can detrimentally affect your emotional wellness and personal satisfaction.

Sadly, monetary strain and emotional wellness issues will in general aggravate each other, making an endless loop. Cash influences our emotional wellness when, for instance, we are extended too slight to even consider meeting the bills we need to pay, or we feel overpowered by our obligation commitments.

The psychological well-being noble cause Mind assesses that individuals in unmanageable obligation are 33 percent bound to endure wretchedness and nervousness than everybody.

What’s more, on the other side, when we feel discouraged and overpowered, we probably won’t have the option to confront opening the bills and obligation letters that show up undesirable in our letterbox. Or on the other hand, we spend to cause ourselves to feel much improved.

The association between our accounts and our perspective is the bedrock of monetary treatment, which has as of late taken off in the United States. Monetary treatment blends down to earth monetary guidance in with more customary enthusiastic and mental treatment.

What this training show is that handling cash issues includes more than doing some bookkeeping and ascertaining spending plans. Dealing with your cash eventually implies dealing with your relationship with cash – that is, how cash causes you to feel and act.

How about we consider some functional exhortation that should help you feel somewhat better about your accounts.

To start with, be reasonable about your planning. Holding yourself to an unreasonable financial plan can cause you to feel horrendous when you overspend. You may then quit any pretense of planning inside and out. Continuously spending some cash for entertainment only, pleasurable encounters as well.

Next, consider getting yourself an organizer and use it to store all your monetary administrative work, for example, bills, receipts, and articulations, in one spot. If you haven’t done this generally, it’s a therapeutic ceremony that does some incredible things to fix the empty head condition.

Furthermore, at last, consider consolidating a mindset journal into your family record. That implies that close by your everyday costs, you can likewise track how you felt when you went through cash. You may, for instance, notice that you possibly do web-based shopping when you’re depleted at night. So you could present a standard where you’re just permitted to make buys toward the beginning of the day – so, all in all, you likely won’t need it any longer.

Chapter 9 – Moral assets are a more secure and more worthwhile alternative for your cash.

Do you uphold the National Rifle Association? Shouldn’t something be said about oil organizations like Shell or Exxon?

You probably won’t be a vocal ally of firearm rights or petroleum products, however, quite possibly you might be propping up these businesses without acknowledging it.

On the off chance that you’ve ever been taken on a working environment benefits, there’s a decent possibility that at least one of the venture finances picked by your annuity supplier remembers shares for organizations you accept to be socially and earth flighty.

So what can be done? You don’t have any state in which your benefits supplier puts resources, isn’t that so?

Luckily, it’s getting simpler for individuals who care about the moral effect of their cash to take care of business.

Most work environment annuity plans should offer you the alternative of changing your default asset to what in particular’s called a moral asset. This is a venture store that rejects organizations considered to be socially or naturally adverse, from weapon producers to betting sites.

You may even have the alternative of putting resources into a positive effect store that goes above and beyond. These take a more proactive position to contribute by just choosing organizations considered to positively affect society. For instance, Dame Helena Morrissey presented the world’s first “young lady reserve,” which just puts resources into organizations with a decent history for sexual orientation balance and variety.

Previously, the issue with putting resources into moral assets was that they weren’t as rewarding. Obviously, in case you’re putting away cash, it’s presumably because you need that cash to develop. This implies you may be enticed to put your advantage before the public great.

Luckily, the view that taking a moral position implies forfeiting monetary return is obsolete. Specialists are progressively voicing the contrary assessment. Moral ventures may be more secure and more worthwhile over the long haul.

This is because of society’s evolving esteems. The more youthful age is undeniably more socially and naturally cognizant than their person born after WW2 guardians, whose abundance they’ll before long be acquiring. Therefore, while organizations like firearm makers and petroleum product suppliers were once sure things, they’re progressively seen as hazardous because of mounting tension on governments to manage these ventures.

Remember that how you manage your cash affects this present reality, so use it shrewdly.

Money: A User’s Guide by Laura Whateley Book Review

Jumping on top of your accounts implies handling both the pragmatic side of cash – figuring out how monetary items work and utilizing them for your potential benefit – and the individual side of cash – figuring out how to control how cash causes you to feel and act.

Handling the down to earth side of cash implies doing a touch of exploration, and ideally, this synopsis has just assisted with demystifying dark subjects, for example, improving your FICO rating or setting up a benefits pot. Understanding the individual side of cash implies doing a little self-reflection. It’s essential to examine your qualities and mentalities toward cash in case you’re to align them with you and your accomplice’s ways of managing money.

Attempt the 50/20/30 procedure.

To financial plan adequately with the least exertion, it assists with placing your pay into discrete pots when it comes inconsistently. The 50/20/30 method gives you a decent gauge of how you should isolate your cash. Put 50% of your pay into a fundamentals account – that implies lease, bills, and driving expenses.

The following 20% goes toward taking care of obligation, or on the off chance that you’ve taken care of all your obligation, you can place it into a bank account. The last 30% goes into your present record, and that establishes as far as possible you can spend on mixed drinks for the month.

Try Audible and Get Two Free Audiobooks

Download Pdf

https://goodbooksummary.s3.us-east-2.amazonaws.com/Money+by+Laura+Whateley+Book+Summary+-+Review.pdf