Austerity is a highly contentious subject that economists have been debating for many years. The problem has been much more important ever since the 2008 financial crisis. To put it in other words, how do you reduce the debt of a country without damaging the economy?

Academic Alberto Alesina, Carlo Favero, and Francesco Giavazzi relied on data for the answer. They collected a large dataset that went from the 1980s to 2010s which included austerity cases in 16 developed countries and found out the impact that such policies had.

The conclusion was startling. Austerity wasn’t always a bad thing as it is generally thought of to be. Sometimes, it was even a good thing resulting in the reelection of some governments.

The authors of this book found out that there are two types of austerity and they are very much different. As a matter of fact, as you will see soon enough, cutting the government budget has very different outcomes compared to a tax raise.

Chapter 1 – Austerity is not necessarily a bad thing when done properly.

The financial crisis in 2008 got everyone, including the general public as well as economists, talking about “austerity”. But what does austerity really mean?

To put it simply, austerity is a form of a government strategy aimed at eliminating a budget shortfall – that is, where government spending is higher than the income it collects – such that the debt level is constant. Governments will do this in two ways: increase taxes, and slash spending.

Despite the fact that some economists and policymakers consider austerity as a smart approach, it could be disfavored with the population at large. And yet research suggests that re-elections are likely after disfavored austerity policies are implemented. Moreover, austerity can even be beneficial for the whole economy.

Austerity wouldn’t be needed in an ideal world. A surplus would be generated when the economy booms and a deficit would be run when it’s in recession – much like a seasonal laborer would invest heavily when revenue comes in and use the money they saved up when employment dries up. Overall, both the surplus and the debt would level out, reducing the need for the dramatic austerity steps.

But this is not generally the case. For starters, governments commonly continue to borrow money even if they are in an economic boom. Second of all, a sudden crisis – such as a pandemic or a war – generally requires high rates of consumption.

To give Italy and Greece as examples, the Great Recession of 2008 was especially harsh on them because they already had high amounts of debt accumulated prior to the crisis. When the crisis happened suddenly in 2008, they had more than one problem.

In such situations, austerity measures are clearly needed. And though austerity policies can go badly, like what happened with Greece, a well-implemented austerity policy will succeed in reducing the deficit without causing significant economic harm.

How can this be possible? With a thorough analysis of a big dataset, the writers got one step closer to the answer. Amid the question’s ambiguity, they find that one point that appears to hold true: budget cuts frequently lead to stronger results than tax rises.

Chapter 2 – Prior studies on austerity didn’t take expectation, incentive, and confidence into account.

John Mayard Keynes was a famous economist of the 20th century whose work is still deemed relevant today.

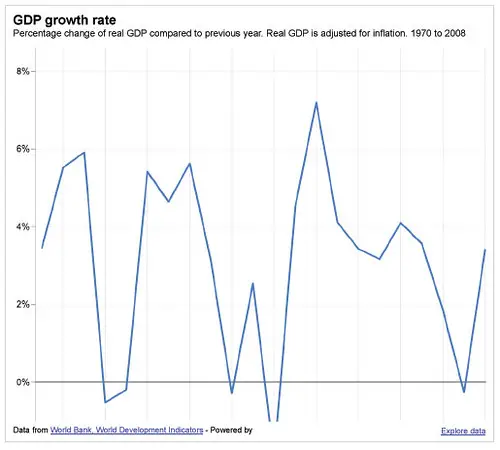

Reducing government spending has a multiplier effect on the economy, he argues – the original reduction has a much larger negative influence on the gross domestic product (also known as GDP). Meanwhile, tax raises often induce a small decrease in GDP – so households have less discretionary income – but the effect is not as dramatic as it is.

The basic model of Keynes has been revised and modified since the 1920s and 1930s but the core of the claim is still commonly accepted. However, the writers argue that even updated versions do not satisfy essential factors – especially, that statements about austerity don’t only have an impact on numbers. They also have an impact on the attitudes and aspirations of people for the future.

Let’s tackle expectations. What people are doing right now is not only present-determined. We also make choices that are based on what we expect will happen in the future. That is a reason why budget cuts will help stimulate the economy, the writers claim.

If government services are to be cut, the general public may well expect future taxes to fall, as the government may not need as much revenue. Therefore people are going to spend more now and hope to pay less tax later. However, if people expect higher future taxes, they will not necessarily wait for that to happen. They are going to start saving immediately.

Sure, this is only true for people who have money to save, since those who can barely afford their living expenses are not able to save. But as more households are able to save, future aspirations form the consequences of austerity.

Price hikes also impact incentives. Higher taxes may make it less enticing for people to work, especially when they are the second earner of a household or approaching retirement. However, reducing transfer costs, such as benefits, may increase incentives since it is likely to motivate people to work.

Another problem is confidence. An investor wouldn’t want to support a government that they don’t think has control over its economy. Cutting spendings can give a direct signal that the state is taking prudent steps – thus raising trust in investors. But, raising taxes does no good for investor confidence – at least not according to the analyzes of the scholars, as we are about to find out.

Chapter 3 – A narrative approach to the data can help us look at the impacts of austerity from a different perspective.

Many past attempts at evaluating austerity have run into the same problem: it is very difficult to measure.

And not just because of the impact of expectation, incentive, and confidence that was previously talked about in the prior chapters. Also, it is difficult to figure out if austerity induced an improvement in a country’s economy at all. For instance, there is a possibility that a country’s deficit will decrease merely due to accelerated growth.

The thing that makes the analysis much more complicated is the fact that transitions from austerity usually emerge over a span of a couple of years, along with shifts in policies along the path. This is the reason why the writers wanted a clearer way of explaining what was actually happening.

The writers follow what they call a narrative approach, factoring in all these complicated motivations. This helps us to see more clearly how austerity policies of a government impact the economy.

The writers’ dataset was taken from 16 relatively affluent countries, mostly in Europe but also including the USA, Canada, Australia, and Japan. They looked at periods of fiscal consolidation -another word for austerity – between 1981 and 2014. In addition to cases from the 1980s and 1990s, a large number of case studies were from the time after the Great Recession of 2007-2009.

Every plan within the dataset was called either expenditure-based (which meant reducing public spending) or tax-based (which meant raising taxes). The complete picture was, surely, more complicated than this, since a traditional austerity plan involves a combination of both. Many of the time, though, a large majority of the savings came from one hand or the other, and the outcomes held up even after eliminating cases where it was near a 50/50 division.

The data only covered situations when policymakers explicitly adopted deficit-reduction strategies, and the writers reported when the austerity measures were declared as well as when they were actually declared. This is the reason why their approach is “narrative” – rather than a sudden imaginary policy change, it recognizes that attitudes change the time that policies are declared.

Chapter 4 – Expenditure-based austerity can deliver good results.

We’ve talked about two types of austerity so far: expenditure-based austerity which focuses on cutting government spending and tax-based austerity which increases the income of the government. The difference between these austerity measures affects the economy differently.

Writers argue that expenditure-based austerity’s impact is much milder than tax increases’. It can even contribute to GDP growth in some cases.

This is what the writers call expansionary austerity – when Keynesian multiplier occurs in reverse, a decrease in spending results in economic growth.

Expansionary austerity is against the economic theory and it is a controversial approach and it doesn’t necessarily always happen when a government cuts spending. Even though we can’t call them norms, we can’t call them exceptions either.

There is an example of Austria in the 1980s. The government announced a range of austerity policies in the first three years of the decade, with 74 percent of those cuts being spending-based. The economy decelerated at first, with cuts totaling 2.5 percent of GDP. But later on, per capita GDP rose by 2 percent in 1982, and 3 percent in 1983.

In the 1990s, Canada achieved expansionary austerity too. Operating from an original 80 percent debt-to-GDP ratio, Progressive Conservative Prime Minister Brian Mulroney avoided increases in government spending and made several cuts. In a 1993 election, the Liberals beat him but they were still pro-austerity so it resulted in more cuts in spending. After all, despite rising cuts, averaging about 0.5 percent of GDP per year, per capita production continued to rise, and the debt-to-GDP ratio started to decrease beginning from 1996.

Thus, although budget cuts in some fields could contribute to lower production, higher demand in other fields may more than makeup for it. To put it another way, expansionary austerity is feasible if the circumstances are correct.

Actually, by integrating all their data to create a typical case scenario, the writers found that expenditure-based austerity policies typically only cause a minor drop in GDP after one year, which then stabilizes into something smaller in the years that follow. The results of expenditure-based austerity are still superior to those of tax-driven austerity even when it isn’t expansionary, as we’ll discover in the next part.

Chapter 5 – Tax-based austerity often ends with worse recessions.

When the writers created their typical scenario, they also examined the effect of tax-based austerity on GDP per capita. In this model, the first outcome of a tax increase was a big drop in GDP, which only became bigger in the years that followed.

This data analysis shows us that tax-based recessions only make economies worse for several years. This is especially astonishing considering the small outcome of expenditure-based austerity.

Take a look at Ireland between 1982 and 1986. The original plan of the government was to get rid of the deficit entirely by 1987, and the primary way they sought to achieve this was by increasing tax, leaving public spending largely untouched. But this hardly even prevented the deficit from increasing. To make things worse, it quickly became clear that the aim of reducing the deficit was definitely not realistic, which created outrage in the general population.

Ireland’s debt-to-GDP ratio ended up increasing – from 74 percent in 1982 to 107 percent in 1986. In 1987, the government finally started to cut spending, and the economy immediately began to grow.

Portugal went through something similar. In 1983, a policy aimed at lowering the budget deficit by 2 percent of GDP was launched. The per capita output of the nation had been increasing when they implemented the policies – 60 percent of them were increases in tax- but then decreased for two consecutive years. Portugal gained far less investment, too. The outcome? In 1984, GDP dropped by 2.3 percent, while Europe’s average was increasing.

The results from the writers’ dataset are obvious: tax-based austerity ends with a decreased output. Although the specifics vary in different situations, this main finding can’t be clarified by variables such as fiscal policy, fluctuating exchange rates, or systemic reforms enacted alongside the austerity steps. Regardless of those variables, tax-based austerity usually results in the same negative outcome.

But for what reason tax-based austerity is far worse than expenditure-based austerity for the economy? There are several reasons, but the one regarding confidence, which we presented in the prior chapter, is one of the most important ones.

To sum up, reducing spending usually contributes to higher confidence in the government thus making it more attractive to investors. In comparison, tax increases decrease the interest of investors due to the detrimental effect on wealth.

Chapter 6 – Austerity has played a crucial role since the financial crisis of 2008 – for better and for worse.

The examples up to this point have been from the 1980s and 1990s. Yet today, we think about more recent times when we hear of austerity since the 2008 financial crash led to major austerity policies in the years that followed.

The debate about austerity has since been intense and sometimes politically driven. That’s why the authors give their data analysis as a look at austerity focused on the truths – even though these findings are complicated and vary greatly from one country to another.

First, let’s talk about the United Kingdom. Its initial response to the 2008 crisis was the implementation of comprehensive monetary policies. The new coalition government finally implemented austerity policies in 2010, mainly in the form of budget cuts. Over five years, the measures totaled to nearly 3 percent of GDP.

Output per capita growth in 2009 was -5 percent, but the six-year trend was +1.6 percent between 2009 and 2015 – a significant reversal. Furthermore, in the 2015 election, the Conservative government behind the steps did well and gained a majority.

What happened with Greece is not as positive. Greece was ruined by the crisis of 2008, after experiencing fast growth since the late 1990s. The government made exceptionally large cuts of 20 percent of GDP from 2010 to 2014. It did not succeed and in 2014 the debt-to-GDP ratio rose to 180 percent.

Why did everything go so bad?

Truth to be told, those amounts of savings were never possible and international bodies have been tough on forcing such measures into the country. The fraught diplomatic condition even made matters worse, with default ruled out as an option.

When austerity started the Greek economy was in horrible conditions – not the ideal time to cut the budget. Yet Greece’s case poses an important question: what is the best time to adopt austerity measures?

It is still a matter of dispute; but, according to the writers, the most critical factor is not usually the exact moment when an austerity policy is being implemented. If the austerity plan is consisting of tax increases or budget cuts is of much greater importance.

Chapter 7 – The politics of austerity is complicated but isn’t always a bad thing politically.

If you’re aiming for a sure path to political victory, that path certainly isn’t increasing taxes and cutting public spending. Electors naturally want low taxes and well-funded services, which also ensures that they promote short-term initiatives without understanding the long-term consequences.

That is the traditional piece of mind, anyway. But, as the writers suggest, governments can thrive at the elections even after austerity measures are implemented.

There are still a lot of considerations that decide the result of an election – above austerity or even the entire economy. Nevertheless, the commonly held presumption that austerity is a recipe for political defeat is not necessarily valid at all.

Canada re-elected its pro-austerity government in 1997, as was the case with Sweden in 1998 and Finland in 1999. And as already stated, after five years of austerity in 2015, the UK’s Conservative party increased its share of the vote. So, even though there is no general law, it’s obvious that not every austerity program leads to a change of government.

What is more complicated than winning an election is running a country. That is a reason why governments still apply tax-based austerity measures, despite their negative outcomes.

Why don’t governments choose budget cuts every time? Besides being hard to apply, they can create problems that are not just about numbers. They tend to come from various areas of the budget after all, and certain politicians will protest strongly against them – both because no politician wants to see their own country’s budget slashed, and they may genuinely believe in the value of a particular system.

Increasing taxes can appear relatively simple compared to the political maneuvering demanded with budget cuts. Moreover, their effect also extends more broadly within society. Indeed, if a country is already in recession, the only viable solution may be tax increases.

The conclusion is that austerity policies aren’t easy to enforce, and certain circumstances – like the one that Greece was in – can prove especially challenging. But, certain conclusions about austerity just are not valid, as the writers claim. Under certain circumstances, austerity will succeed if it’s applied correctly.

Austerity: When It Works and When It Doesn’t by Alberto Alesina, Carlo Favero, Francesco Giavazzi Book Review

Austerity has a bad name but it can be beneficial for the economy of a nation, according to the carefully collected data of the writers. Among the two types of austerity, expenditure-based austerity usually results in much better outcomes than tax-based austerity. Budget cuts can also contribute to an acceleration of the economy, whereas increases in taxes usually have a decidedly negative effect.